Once again, US officials are repeating the “debt trap” argument during their visit to Africa, claiming that China is burdening African countries with unsustainable debt. Is their argument correct or is the so-called Chinese debt trap a lie concocted by the US and Western countries to deflect their responsibility and blame? Here are facts that People\’s Daily Online has collected.

Commercial and multilateral lenders are the largest creditors of African total external debt, accounting for nearly three-quarters

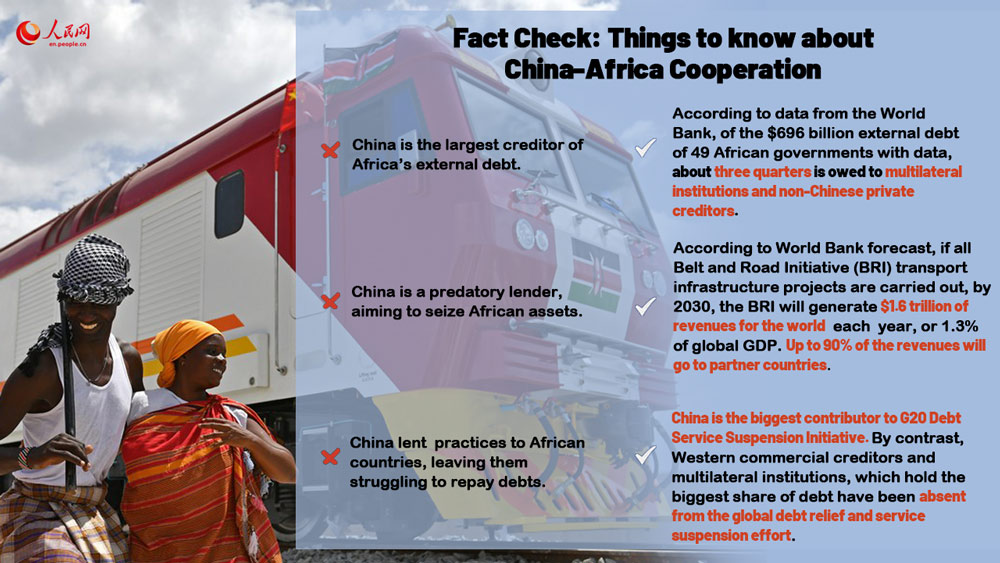

According to data from the World Bank, of the $696 billion external debt of 49 African governments with data, about three quarters is owed to multilateral institutions and non-Chinese private creditors. Debt Justice found that for the 24 African countries with the highest debt burdens, the median share of their external debt payments from 2022 to 2028 to non-Chinese private creditors and multilateral creditors is projected to be 32% and 35% respectively. The average interest rate on loans from Western private lenders is almost twice that of Chinese lenders.

For instance , multilateral financial institutions account for 24 percent of Zambia\’s foreign debt, while predominantly Western commercial lenders account for 46 percent. Combined, they hold the bulk of Zambia\’s foreign debt.

The US and Western countries should be held responsible for creating the \”debt trap.\” Their expansionary monetary policies, lax supervision over financial innovations, and ill-intended short-selling are weighing developing countries down with debt burden, which is why some countries have fallen into the debt trap.

China-Africa cooperation has delivered tangible benefits for African countries and its people

Africa\’s debt problem is an issue of development. China\’s financing cooperation with Africa is mainly in infrastructure development and production capacity, and aims to enhance Africa\’s ability to develop independently and sustainably.

Since the beginning of the new century, China has built over 6,000 kilometers of railways, 6,000 kilometers of roads, nearly 20 ports, and over 80 extensive power facilities in Africa, and helped build over 130 hospitals and clinics, over 170 schools, 45 sports venues, and over 500 agricultural projects there. These projects have played an essential part in boosting Africa’s socio-economic development and improving people\’s livelihoods, and have been widely appreciated by African countries and people.

Kenya\’s Mombasa-Nairobi Standard Gauge Railway (SGR ) is a prime example of this. It has boosted Kenya\’s socio-economic development and improved people\’s livelihoods since it started operating five years ago, contributing over 2 percent to Kenya\’s GDP and creating nearly 50,000 jobs in Kenya. Over 80 percent of their employees are locals for most of those jobs. The newly inaugurated Lekki Deep Sea Port in Nigeria, the biggest deep sea port in West Africa, is expected to generate nearly US$360 billion in overall economic benefits and create 170,000 jobs

According to the World Bank forecast , if all Belt and Road Initiative (BRI) transport infrastructure projects are carried out by 2030, the BRI will generate $1.6 trillion in revenues yearly, or 1.3% of global GDP. Up to 90% of the revenues will go to partner countries, and upper-middle- and low-income corridor economies are expected to benefit the most. The BRI could contribute to lifting 7.6 million people out of extreme poverty and 32 million out of moderate poverty from 2015 to 2030.

China is the biggest contributor to G20 Debt Service Suspension Initiative

China has always been committed to helping Africa ease its debt burden, actively participated in the Group of 20 (G20) Debt Service Suspension Initiative, signed agreements or reached consensuses with 19 African countries on debt relief and suspended the most debt service payments among G20 members. China has also been actively engaged in the case-by-case debt treatment for Chad, Ethiopia and Zambia under the G20 Common Framework. By contrast, Western commercial creditors and multilateral institutions, which hold the biggest share of debt, have been absent from the global debt relief and service suspension effort. They claimed that they need to maintain their credit rating and have thus refused to be part of the effort, and failed to make proportionate contributions to relieving the debt burden of developing countries.

Therefore, China\’s so-called \”debt trap\” in Africa is a narrative trap that cannot withstand scrutiny.